www.auto-innovations.net

24

'23

Written on Modified on

Interact Analysis News

Are lubricant manufacturers ready for seismic impact of zero emission transport?

Article by ALASTAIR HAYFIELD, Senior Research Director of Commercial Vehicles Division, interact analysis, and responsible for cutting-edge research on electric trucks, autonomous trucks and off-highway electrification.

Massive changes are set to take place over the next decade that will rock the lubricants industry to its core and manufacturers need to start preparing now.

There is no getting around the fact that electric vehicles have less need for lubricant as they have fewer moving parts, so the market will get smaller over time. However, progress in the off-highway commercial vehicles segment in particular is slow, with very few larger vehicles in particular electrified or available on the market, so there is still time to get ahead of the curve. And new lubricants and formulations will be needed to optimize the performance of new fuel vehicles, providing fresh opportunities for the future.

According to our research, many lubricants companies need more information and analysis when it comes to getting prepared, as the days of diesel as the leading vehicle fuel are numbered.

Forewarned is forearmed and that’s why as a market intelligence specialist, we at Interact Analysis have produced a new report Global Truck, Bus and Off-highway Vehicle Electrification and Alternative Fuel: How will electrification and alternative fuels shape the commercial vehicle fuel and lubricant markets?, in order to provide lubricant developers, manufacturers and vendors with information and insight into the future of the commercial vehicles industry and how developing trends are likely to affect them.

By starting to get ready now and taking steps to evolve their business, lubricant manufacturers could find some exciting new opportunities. Indeed, some already have e-lubricant formulations on the market or in development.

Change is not taking place overnight, particularly in the off-highway market

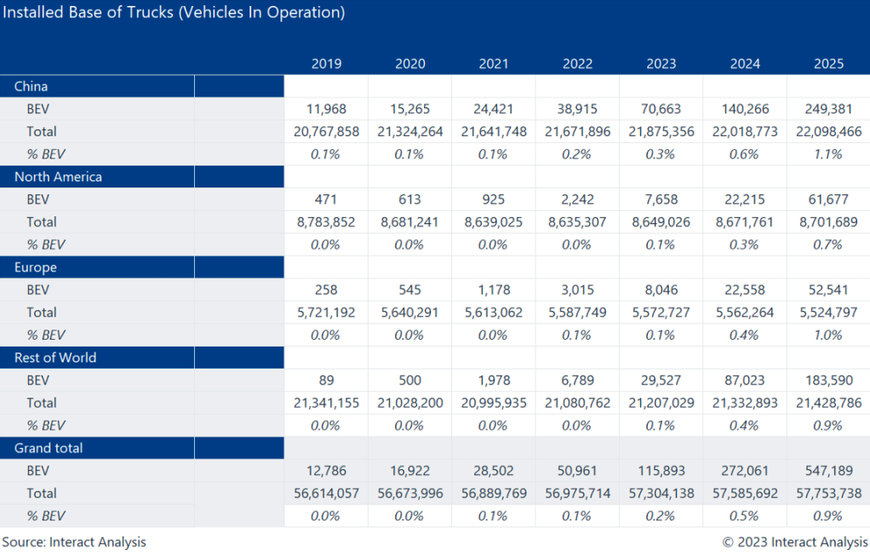

A rapid uptake of battery electric trucks and buses is going to reduce demand for diesel fuel. This has started off slowly, but will accelerate out to 2030, particularly in certain markets. The total number of battery electric trucks in operation will rise to around 1% by 2025. However, by 2030 7% of trucks on the road are forecast to be batter electric.

The off-highway market is taking a much longer time to transition towards electrified and new fuel power trains and away from combustion, particularly when it comes to larger machinery. This is partly because of the variations between machines, each often requiring different design and components, whereas most trucks are very similar in terms of design and components.

So, if you are in the lubricants industry, you don’t need to switch everything over immediately, but it’s a clear trend towards electrification in particular.

New formulations offer additional opportunities

As there is greater demand for more sustainable and environmentally-sensitive products, there are huge opportunities to develop greener lubricants. For instance, products are already in development for the forestry industry and for machines used in the food & drink, where health, safety and the environment are of greater significance.

Tailored e-lubricants could provide a potential new market for manufacturers, with products that enhance the performance and longevity of moving parts, with some companies already entering the arena or developing new formulations. With the importance of reducing friction and energy consumption even more important for new fuel vehicles, in order to conserve battery life or reduce time between refueling, there are very real opportunities for those companies that create new formulations for zero emission vehicles.

Hydrogen ICE could provide more opportunities, as there is a greater need for lubricants, and the engines are more similar to conventional ICE. However, the market is moving slowly and It should probably come as no surprise that material handling solutions – like forklifts or AWPs – are electrifying fastest. Larger construction equipment could be better suited to hydrogen ICE and more tailored formulations in the longer term as it is not easily powered by BEV technology, and machinery deployed in remote locations cannot be easily recharged.

Now is a great time to think about what these new formulations might look like or what gets the best performance out of an electric, hydrogen or biodiesel engine. Keeping an eye on the electrification and new fuel trends and forging partnerships with companies like manufacturers developing new fuel engines now could result in big payoffs in the future.

There is still time to plan, reformulate and grow new markets

Although there is an irreversible move towards zero emission vehicles both on and off-highway, global population and economy are expected to continue to grow, resulting in a slight increase in the total number of vehicles. With some segments, such as large off-highway vehicles and long-haul trucks likely to electrify slowly, sales of electric vehicles may remain low even by 2030. Therefore, it seems reasonable as an initial estimate to assume that the total volume and revenue of lubricant sales in 2030 should stay similar to 2023.

This means there is still scope to plan and prepare for the huge changes afoot (or onboard) for commercial vehicles. Those companies start work now will give themselves a huge competitive advantage and could maintain sales while the market itself is contracting.

There is time to train employees, develop new formulations and build up supply chains. We are already seeing this movement in other related areas, such as filtration systems or fuel injection systems, so start your R&D early. With electric trucks, buses and off-highway vehicles already on the market and H2 ICE trials taking place, if you’re not involved the likelihood is you’ll miss out.

Another way of growing sales may be to target regions that are taking longer to electrify vehicles and where there are fewer subsidies for zero emission technology, such as South America and Africa. These are likely to keep their fuel injection markets for longer.

It’s a gradual transition, but at the moment one that looks inevitable. So, don’t get left behind. One of the ways you can start to prepare, if you haven’t already, is to download the Interact Analysis Global Truck, Bus and Off-highway Vehicle Electrification and Alternative Fuel: How will electrification and alternative fuels shape the commercial vehicle fuel and lubricant markets? Report.

www.interactanalysis.com